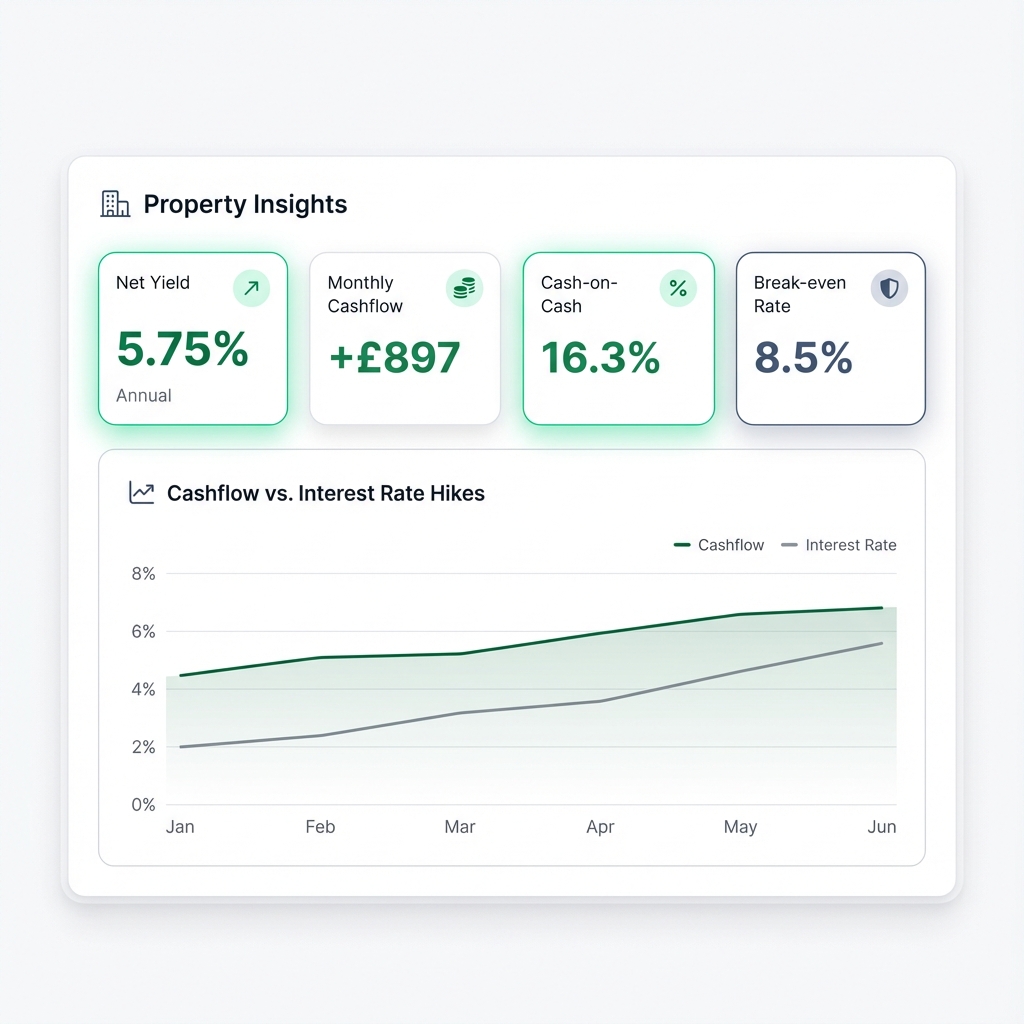

Know your Real Return.

Not just gross yield.

- Net yield after real UK costs (service charge, etc)

- Monthly cashflow & return on equity

- Stress test interest rates (find your break point)

"Built by UK property investors frustrated with misleading yield calculators."

Most yield calculators miss the costs that matter.

They show you "Gross Yield" but ignore the 40% of income that disappears into service charges, agent fees, maintenance, and voids.

- Ignoring Service Charges (£1000s/year)

- Forgetting Agent Fees (10-15% + VAT)

- No Stress Testing for Rate Hikes

Our Real-World Analysis

Not all calculators are created equal.

Standard calculators give you a vanity metric. RealYield gives you an investment strategy.

| Feature | Basic Tools | RealYield |

|---|---|---|

| Gross Yield Calculation | ||

| Service Charge Adjustments | ||

| Agent Fee (% or £) Toggles | ||

| Mortgage Stress Testing | ||

| Safety Headroom (Break-even) | ||

| AI Deal Intelligence | ||

| Shareable Deal Links | ||

| Void Period Modeling | Basic | Advanced |

AI-Powered

Context-aware insights for the 2025 UK market.

Shareable

Send live deal links to partners or lenders.

Real-Time

Instant feedback as you adjust the numbers.

Professional Analysis

In a Single Click.

Stop guessing. Our AI engine analyzes every variable—from local service charges to interest rate sensitivity—to give you a professional investment verdict instantly.

The Verdict

A one-sentence "Go" or "No-Go" summary of the deal.

Risk Assessment

Deep dive into the Break-even rate and sensitivity to voids.

Actionable Tips

Specific advice on how to improve the deal's ROI.

Your break-even rate is 8.54%. This gives you a 7.07% buffer against current market rates.

The "Real World" Gaps

Most calculators ignore the reality of UK property investing. Here is an actual London leasehold flat example. Note the difference between "Yield" and "Reality".

Property Details

The "Real Costs" often ignored:

- Service Charge-£3,420

- Agent Fees-£1,900

- Mortgage Interest-£1,740

- Total Running Costs-£9,040 /yr

Our 4-Perspective Analysis

Built by UK landlords for investors.

Pays you comfortably every month.

Return on your £66k equity. The killer metric.

Make Smarter Investment Decisions

Ready to run your own numbers?

Get early access to the beta. It takes 5 seconds to join.